As Best private health insurance plans in the US 2025 take the spotlight, this introduction invites readers with a well-informed narrative, ensuring an engaging and uniquely original reading experience.

The following paragraph will delve into the specifics of the topic, providing a clear and descriptive overview.

Overview of Private Health Insurance Plans in the US 2025

Private health insurance plans in the US play a crucial role in providing individuals with access to quality healthcare services. These plans are offered by various insurance companies and help cover medical expenses, including hospital stays, doctor visits, and prescription medications.

By 2025, the industry is expected to witness significant changes and trends that will impact how individuals access and pay for healthcare services. Having private health insurance in the US is essential as it offers financial protection against high medical costs and ensures timely access to medical care.

Types of Private Health Insurance Plans

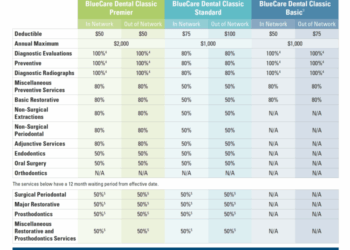

Private health insurance plans in the US encompass a variety of options to cater to different healthcare needs. The main types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans.

Each type has its own coverage, benefits, and limitations, providing individuals with a choice based on their preferences and requirements.

Factors to Consider When Choosing a Private Health Insurance Plan

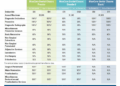

When selecting a private health insurance plan, individuals should consider various factors such as premiums, deductibles, copayments, and coverage options. It is crucial to evaluate the cost implications of the plan and ensure that it aligns with one's budget and healthcare needs.

Additionally, assessing the network of healthcare providers included in the plan is important to ensure access to quality care when needed.

Top Private Health Insurance Providers in the US 2025

Leading private health insurance companies in the US play a significant role in offering diverse coverage options to individuals. These insurers are known for their reputation, customer satisfaction, and innovative features in their plans. By 2025, these companies are expected to continue providing reliable and comprehensive coverage to meet the evolving healthcare needs of the population.

Emerging Trends in Private Health Insurance for 2025

The year 2025 is likely to witness emerging trends in private health insurance plans, including advancements in telehealth services and digital health tools. Insurance companies are adapting to changes in healthcare delivery and consumer preferences by incorporating technology-driven solutions to improve access to care and enhance overall patient experience.

These trends are reshaping the landscape of private health insurance and driving innovation in the industry.

Conclusion

Wrapping up the discussion on Best private health insurance plans in the US 2025, this concluding section offers a concise summary and final reflections in a captivating manner.

Commonly Asked Questions

What are the key trends expected in the private health insurance industry by 2025?

Answer: The industry is expected to see advancements in telehealth services and digital health tools, along with changes in healthcare delivery and consumer preferences.

How should individuals choose a private health insurance plan?

Answer: Factors to consider include cost implications like premiums, deductibles, and copayments, as well as evaluating the network of healthcare providers and coverage options.

Which are the top private health insurance providers in the US for 2025?

Answer: The leading companies will be highlighted based on offerings, reputation, and customer satisfaction, with a discussion on any unique features or innovations.

What are some emerging trends in private health insurance for 2025?

Answer: Emerging trends include advancements in telehealth services, digital health tools, and adaptations by insurance companies to changes in healthcare delivery and consumer preferences.