Affordable international health insurance for expats opens the door to a world of possibilities, ensuring that those living abroad have access to quality healthcare without breaking the bank. As expats navigate the complexities of living in a foreign land, having the right insurance coverage becomes paramount in safeguarding their well-being.

Let's delve into the realm of affordable international health insurance and explore how it can provide peace of mind and security for expats worldwide.

In this comprehensive guide, we will uncover the key aspects of affordable international health insurance, from understanding its definition to exploring the benefits and factors to consider when choosing the right plan. Join us on this journey to discover how expats can access quality healthcare while staying within budget constraints.

Overview of Affordable International Health Insurance for Expats

Affordable international health insurance for expats refers to insurance plans that offer coverage at a reasonable cost for individuals living and working abroad. These policies are designed to meet the specific healthcare needs of expatriates while keeping the premiums within a manageable budget.

Having international health insurance coverage is crucial for expats as it provides financial protection and access to quality healthcare services in foreign countries. Without adequate insurance, expats may face exorbitant medical expenses or limited healthcare options, leading to potential health risks and financial burdens.

Key Factors Making Health Insurance Affordable for Expats

- Customized Plans: Affordable international health insurance providers offer tailored plans that cater to the unique needs of expats, including coverage for preventive care, emergency medical services, and chronic conditions.

- Network of Providers: Insurance companies partner with a global network of healthcare providers to offer discounted rates for medical services, making healthcare more affordable for expats.

- Cost-sharing Options: Some insurance plans allow expats to choose cost-sharing options such as deductibles and co-payments, which can help lower monthly premiums while still providing comprehensive coverage.

- Competitive Pricing: With the increasing demand for international health insurance, providers are offering competitive pricing to attract expat customers, making quality coverage more accessible and affordable.

Benefits of International Health Insurance for Expats

International health insurance offers a range of benefits for expats living and working abroad. These benefits go beyond what local health coverage typically provides, offering expats peace of mind and access to quality healthcare wherever they are in the world.

Comprehensive Coverage

International health insurance usually provides comprehensive coverage for a wide range of medical services, including hospitalization, outpatient care, prescription drugs, and emergency medical evacuation. This ensures that expats have access to the care they need without worrying about high out-of-pocket expenses.

Global Network of Providers

One of the key benefits of international health insurance is access to a global network of healthcare providers. This means that expats can receive treatment from trusted medical professionals in different countries, ensuring high-quality care no matter where they are located.

Emergency Assistance Services

International health insurance often includes emergency assistance services, such as 24/7 helplines, medical advice, and coordination of emergency medical evacuation. In times of crisis or unforeseen medical emergencies, these services can be lifesaving for expats far from home.

Portability and Flexibility

Unlike local health coverage, international health insurance is portable and flexible, allowing expats to move between countries without losing coverage. This flexibility is especially important for expats who frequently travel or relocate for work, providing continuity of care wherever they go.

Real-Life Scenario:

For example, imagine an expat living in a remote area where local healthcare facilities are limited. With international health insurance, they can access a global network of providers and receive treatment from top medical professionals, ensuring they receive the best care possible even in challenging circumstances.

Factors to Consider When Choosing Affordable Health Insurance for Expats

When selecting health insurance as an expat, there are several crucial factors to consider to ensure you have the right coverage at an affordable price. Understanding how coverage limits, deductibles, and premiums impact the overall affordability of health insurance is key.

Here are some tips on how expats can tailor their insurance plan to suit their needs while keeping it affordable.

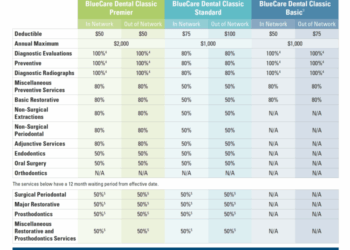

Coverage Limits

- It is important to carefully review the coverage limits of your health insurance plan to ensure that it meets your specific needs.

- Consider the maximum amount the insurance company will pay for different types of medical services or treatments.

- Choose a plan with coverage limits that align with your potential healthcare needs to avoid out-of-pocket expenses.

Deductibles

- Understand the deductible amount you will be required to pay before your insurance coverage kicks in.

- Higher deductibles typically result in lower premiums, but it's essential to assess your financial situation and health needs before choosing a plan.

- Consider your ability to pay the deductible in case of a medical emergency before finalizing your insurance policy.

Premiums

- Compare premiums from different insurance providers to find a plan that fits your budget while offering adequate coverage.

- Consider the trade-off between premiums and coverage benefits to strike a balance between affordability and comprehensive healthcare protection.

- Look for discounts or special offers that may lower your premium costs without compromising on essential coverage.

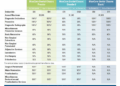

Review of Popular Affordable International Health Insurance Providers

When it comes to choosing the right international health insurance provider as an expat, it's essential to consider various factors such as coverage, costs, and services offered. To help you make an informed decision, here is a review of some well-known providers catering to expats.

1. Cigna Global

Cigna Global is a popular choice among expats for its comprehensive coverage options that include inpatient, outpatient, and emergency medical services. They offer flexible plans to suit different needs and budgets, with a reputation for excellent customer service.

2. Allianz Care

Allianz Care is known for its extensive network of healthcare providers worldwide, making it convenient for expats to access quality medical services wherever they are. They offer competitive pricing and customizable plans to meet individual preferences.

3. Aetna International

Aetna International is another reputable provider offering a wide range of health insurance solutions for expats. They focus on delivering innovative healthcare solutions and personalized support to ensure the well-being of their members.

4. AXA Global Healthcare

AXA Global Healthcare is recognized for its global presence and commitment to providing reliable health insurance solutions for expats. They offer comprehensive coverage options, including preventive care and wellness programs, to promote overall health and well-being.

Tips for Saving Money on International Health Insurance

When it comes to saving money on international health insurance as an expat, there are several strategies you can consider to reduce your premiums and overall costs. By being proactive and making informed decisions, you can potentially lower your expenses while still ensuring comprehensive coverage for your healthcare needs.

Healthy Lifestyle Choices and Preventive Care

One effective way to save money on international health insurance is by prioritizing your health through adopting a healthy lifestyle and focusing on preventive care. By maintaining a balanced diet, engaging in regular exercise, and avoiding harmful habits such as smoking, you can reduce your risk of developing costly health conditions.

Additionally, attending preventive screenings and check-ups can help detect any potential health issues early on, preventing more serious and expensive treatments in the future.

Negotiating Better Rates with Insurance Providers

Another strategy to consider is negotiating better rates or discounts with your insurance provider. It's worth exploring whether there are any available discounts based on your profile, such as being a non-smoker or having a clean medical history. Additionally, you can inquire about any loyalty discounts or special promotions that could potentially lower your premiums.

By being proactive and engaging with your insurance provider, you may be able to secure a more affordable rate without compromising on coverage.

Final Thoughts

In conclusion, affordable international health insurance for expats not only offers financial protection but also ensures access to top-notch medical services wherever they may be. By carefully considering the factors discussed and exploring the available options, expats can make informed decisions that prioritize their health and well-being.

As the world becomes increasingly interconnected, having the right insurance coverage is no longer a luxury but a necessity for expats around the globe.

Popular Questions

Is international health insurance necessary for expats?

Yes, international health insurance is crucial for expats as it provides coverage across different countries and ensures access to quality healthcare services.

How can expats save money on their health insurance premiums?

Expats can save money by comparing different insurance providers, opting for higher deductibles, and maintaining a healthy lifestyle to reduce insurance costs.

What are some popular international health insurance providers for expats?

Popular international health insurance providers for expats include Cigna Global, Allianz Care, and AXA Global Healthcare, among others.