Delving into the realm of selecting health insurance with mental health coverage, this guide offers a comprehensive and insightful look at the factors to consider. From understanding the nuances of mental health coverage to evaluating different options, this topic sheds light on a crucial aspect of healthcare decisions.

Exploring the intricacies of mental health coverage in insurance plans opens up a world of considerations that can greatly impact one's well-being and financial security.

Understanding Mental Health Coverage

Health insurance plans that include mental health coverage offer benefits for services related to mental health conditions and treatment. This coverage is essential for individuals seeking support for their mental well-being.

Key Components of Mental Health Coverage

- Therapy Sessions: Coverage for therapy sessions with licensed mental health professionals.

- Medication: Coverage for prescribed medications related to mental health treatment.

- Inpatient Services: Coverage for inpatient treatment in mental health facilities when necessary.

- Outpatient Services: Coverage for outpatient mental health services like counseling or group therapy.

- Preventive Care: Coverage for preventive mental health screenings and assessments.

Importance of Mental Health Coverage

Mental health coverage is crucial for holistic healthcare as it ensures that individuals have access to the necessary resources for managing mental health conditions. By including mental health coverage in insurance plans, individuals can seek treatment without financial barriers, leading to improved overall well-being and quality of life.

Types of Mental Health Services Covered

When it comes to mental health services covered by insurance, there are various types of treatments and therapies that are typically included in most plans. Understanding what is covered can help you make informed decisions about your mental health care.

Counseling and Therapy

- Individual therapy sessions with a licensed therapist

- Group therapy sessions for specific mental health conditions

- Couples or family therapy for relationship issues

Psychiatric Services

- Patient evaluations by a psychiatrist for medication management

- Prescription medications for mental health conditions

- Follow-up appointments with a psychiatrist for ongoing care

Intensive Outpatient Programs (IOP)

- Structured programs offering more intensive therapy than traditional outpatient services

- Partial hospitalization programs for individuals needing more support than outpatient therapy

- Day treatment programs for comprehensive care during the day while allowing for evenings at home

Telehealth and Online Therapy

- Virtual therapy sessions with licensed mental health professionals

- Remote psychiatric evaluations and medication management

- Online support groups and forums for additional mental health support

Limited Coverage and Exclusions

It's important to note that not all mental health services may be covered by insurance. Some plans may have limitations on the number of therapy sessions allowed per year or exclude certain types of treatments. It's crucial to review your policy to understand any restrictions that may apply.

Examples of Common Mental Health Services Covered

- Diagnostic assessments for mental health conditions

- Psychotherapy sessions with a licensed counselor

- Medication management for psychiatric conditions

- Emergency mental health services and crisis intervention

Evaluating Coverage Options

When choosing a health insurance plan with mental health coverage, it is crucial to carefully evaluate the different options available to ensure you receive adequate benefits for your mental health needs.Discussing with a healthcare provider or a mental health professional can help you determine the level of coverage you may require based on your individual needs and circumstances.

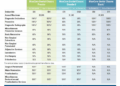

Comparing Plans

- Review the mental health services covered under each plan, including therapy sessions, medication, and hospitalization.

- Compare the out-of-pocket costs, such as copayments and deductibles, for mental health services across different plans.

- Consider the network of mental health providers included in each plan to ensure you have access to quality care.

Determining Adequate Benefits

- Ensure that the plan covers a wide range of mental health conditions, including common disorders like depression, anxiety, and bipolar disorder.

- Check if there are any restrictions or limitations on the number of therapy sessions or mental health visits allowed per year.

- Verify if the plan offers coverage for both in-network and out-of-network mental health providers to give you more options for care.

Tips for Evaluation

- Read the plan documents carefully to understand the specifics of the mental health coverage provided.

- Consider your current mental health needs and any potential future needs to select a plan that offers comprehensive coverage.

- Seek guidance from a healthcare advocate or insurance expert if you need assistance navigating the complexities of insurance plans.

Network of Providers

Having a network of mental health providers within an insurance plan is crucial for ensuring access to quality care while keeping costs manageable. In-network providers have agreements with the insurance company to provide services at a discounted rate, which can result in lower out-of-pocket expenses for policyholders.

Checking In-Network Providers

When selecting a health insurance plan with mental health coverage, it is important to verify if your preferred mental health professionals are part of the network. This can usually be done by visiting the insurance company's website or contacting their customer service department.

It is advisable to confirm the network status of the providers you wish to see before enrolling in a plan.

- Check the insurance company's online provider directory.

- Contact the provider directly to inquire about their network participation.

- Ask the insurance company for a list of in-network mental health providers in your area.

Implications of Using Out-of-Network Providers

Opting to see an out-of-network mental health provider may result in higher out-of-pocket costs for the policyholder. Insurance plans typically offer less coverage for out-of-network services, requiring the individual to pay a larger share of the costs. Additionally, reimbursement rates for out-of-network services may vary, leading to potential billing discrepancies and financial surprises for the policyholder.

It is important to carefully consider the network status of mental health providers when choosing a health insurance plan to ensure access to affordable and comprehensive care.

Cost Considerations

When choosing health insurance with mental health coverage, it's essential to consider the costs associated with these services. Understanding the financial aspects can help you make informed decisions about your coverage.

Typical Costs

- Out-of-pocket expenses: These are costs that you will need to pay yourself, such as copayments, deductibles, and coinsurance.

- Copayments: A fixed amount you pay for a covered service, usually due at the time of the appointment.

- Deductibles: The amount you need to pay out of pocket before your insurance starts covering the costs.

- Coinsurance: The percentage of costs you are responsible for after meeting your deductible.

Estimating Out-of-Pocket Expenses

It's important to estimate your potential out-of-pocket expenses related to mental health services. You can do this by:

- Reviewing your insurance plan documents to understand your coverage and costs.

- Calculating the copayments, deductibles, and coinsurance you may incur for mental health care.

- Considering the frequency of visits and treatments you anticipate needing.

Importance of Understanding Copayments, Deductibles, and Coinsurance

Understanding copayments, deductibles, and coinsurance is crucial for managing your mental health care costs. This knowledge can help you:

- Plan your budget effectively and avoid unexpected financial burdens.

- Compare different insurance plans to find the most cost-effective option for your needs.

- Be prepared for the financial responsibilities associated with mental health services.

Additional Benefits and Support

When selecting a health insurance plan with mental health coverage, it's essential to consider the additional benefits and support that some plans offer specifically for mental health care. These extra features can enhance your overall mental well-being and make a significant difference in your treatment journey.

Telehealth Services for Mental Health

Telehealth services have become increasingly popular in the mental health field, allowing individuals to access care remotely through virtual appointments. Many insurance plans now include coverage for telehealth services for mental health, making therapy sessions more accessible and convenient. This option can be particularly beneficial for individuals with busy schedules, mobility limitations, or those living in remote areas.

- Telehealth services provide a convenient way to access mental health care from the comfort of your home.

- Virtual therapy sessions can help reduce barriers to treatment, such as transportation issues or time constraints.

- Insurance plans that cover telehealth services may offer a more extensive network of mental health providers for you to choose from.

Mental Health Support Programs

In addition to traditional therapy sessions, some insurance plans offer mental health support programs designed to supplement your treatment and promote holistic well-being. These programs can include resources such as wellness workshops, stress management techniques, and mental health hotlines for immediate support.

It's crucial to consider mental health support programs when choosing an insurance plan, as they can provide valuable resources and tools to help you manage your mental health more effectively.

- Wellness workshops and educational materials can empower you with knowledge and skills to cope with mental health challenges.

- Stress management techniques and relaxation exercises can assist in reducing anxiety and improving overall mental well-being.

- Mental health hotlines offer immediate support during times of crisis or when you need someone to talk to urgently.

Wrap-Up

In conclusion, navigating the landscape of health insurance while prioritizing mental health coverage is a balancing act that requires careful consideration and informed choices. By understanding the key elements discussed in this guide, individuals can make confident decisions that support their mental and physical health needs.

FAQ Corner

How do I know if a health insurance plan covers mental health services?

Most insurance plans provide information on their coverage for mental health services in the plan documents or on their website. You can also call the insurance company to inquire about specific coverage details.

Are there any restrictions on the number of therapy sessions covered by insurance?

Some insurance plans may limit the number of therapy sessions covered in a year. It's important to review your plan's details to understand any such restrictions.

Can I choose any mental health provider with my insurance plan?

Insurance plans often have a network of providers. Choosing an in-network provider can help lower your out-of-pocket costs. You can check the plan's website or contact them to find in-network providers.

Do all health insurance plans cover telehealth services for mental health?

Not all plans cover telehealth services for mental health. It's essential to review the plan details or contact the insurance company to check if telehealth services are included in your coverage.