Beginning with Employee Health Insurance Explained: Benefits Every Worker Should Know, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

As we delve into the complexities of employee health insurance, it becomes evident why understanding its benefits is crucial for every worker. From coverage details to costs and enrollment processes, this guide aims to shed light on the essentials of this vital aspect of employment benefits.

Importance of Employee Health Insurance

Employee health insurance is a crucial benefit that provides financial protection and access to healthcare services for workers. It plays a significant role in ensuring the well-being and productivity of employees in the workplace.

Benefits of Employer-Provided Health Insurance

- Employer-provided health insurance helps employees cover medical expenses, including preventive care, treatments, and medications, without incurring high out-of-pocket costs.

- It offers a sense of security and peace of mind to employees, knowing that they have access to quality healthcare services when needed, reducing stress and anxiety related to health concerns.

- Health insurance can attract top talent and retain skilled employees, as it is a valuable benefit that contributes to job satisfaction and overall employee wellness.

- By promoting regular check-ups and preventive care, employer-provided health insurance can help detect and address health issues early, leading to better health outcomes and lower healthcare costs in the long run.

Impact of Health Insurance on Employee Well-Being and Productivity

Studies have shown that employees with access to health insurance are more likely to seek medical care when needed, leading to improved health outcomes and reduced absenteeism in the workplace.

According to the Kaiser Family Foundation, 56% of covered workers in the U.S. have access to employer-sponsored health insurance, highlighting its prevalence and importance in the workforce.

Health insurance also contributes to higher job satisfaction and morale among employees, as they feel supported by their employers in maintaining their health and well-being.

Types of Employee Health Insurance Plans

Employee health insurance plans come in various types to cater to different needs and preferences. Understanding the differences between these plans can help employees make informed decisions about their healthcare coverage.

HMO, PPO, and High-Deductible Health Plans

- HMO (Health Maintenance Organization):HMO plans typically require employees to choose a primary care physician (PCP) who coordinates all of their healthcare needs. Referrals are usually needed to see specialists, and coverage is limited to a network of providers.

- PPO (Preferred Provider Organization):PPO plans offer more flexibility in choosing healthcare providers. Employees can see specialists without referrals, both in and out of the network, but out-of-network care may come with higher out-of-pocket costs.

- High-Deductible Health Plans:These plans have lower monthly premiums but higher deductibles. They are often paired with Health Savings Accounts (HSAs) to help employees save for medical expenses.

Traditional Health Insurance vs. Health Savings Accounts (HSAs)

- Traditional Health Insurance:Traditional plans involve paying a set premium for coverage, with copayments and coinsurance for services. Employees may have limited control over how their premiums are spent.

- Health Savings Accounts (HSAs):HSAs are savings accounts employees can use to pay for qualified medical expenses. Contributions are tax-deductible, and funds can be rolled over each year, making it a valuable tool for saving money on healthcare costs.

Self-Insured Health Plans

Self-insured health plans are when an employer assumes the financial risk for providing healthcare benefits to employees. Instead of paying premiums to an insurance company, the employer sets aside funds to cover healthcare expenses directly. This approach can offer cost savings, more flexibility in plan design, and the ability to tailor benefits to the specific needs of the workforce.

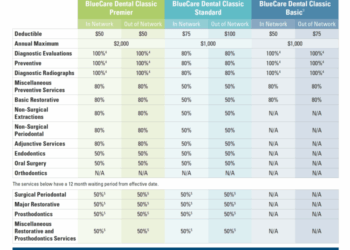

Coverage and Benefits

When it comes to employee health insurance, understanding the coverage and benefits is crucial for every worker. This section will delve into the common medical services covered by most health insurance plans, the importance of preventive care and wellness programs, as well as the role of prescription drug coverage and mental health services in promoting overall employee well-being.

Common Medical Services Covered by Health Insurance Plans

- Doctor visits for illness or injury

- Emergency room visits

- Hospital stays

- Laboratory tests and diagnostic procedures

- Preventive care services such as vaccinations and screenings

Significance of Preventive Care and Wellness Programs

Preventive care and wellness programs play a vital role in employee health insurance by focusing on maintaining good health and preventing future health issues. By promoting regular check-ups, screenings, and lifestyle changes, these programs can help employees stay healthy and reduce the risk of chronic diseases.

Role of Prescription Drug Coverage and Mental Health Services

Prescription drug coverage ensures that employees have access to necessary medications prescribed by their healthcare providers. This is essential for managing chronic conditions and improving overall health outcomes. Mental health services, on the other hand, address the psychological well-being of employees by providing counseling, therapy, and support for mental health conditions such as anxiety, depression, and stress.

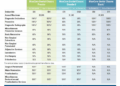

Costs and Contributions

When it comes to employee health insurance, understanding the costs and contributions is essential for both employers and employees. Let's delve into how premium contributions are typically divided and the common out-of-pocket costs involved.

Premium Contributions

Employers and employees often share the cost of health insurance premiums. While the specific breakdown can vary, it's common for employers to cover a significant portion of the premium, with employees contributing the rest through paycheck deductions. This shared responsibility helps make health insurance more affordable for employees while still providing valuable coverage.

Out-of-pocket Costs

Out-of-pocket costs are expenses that employees must pay directly when they receive medical care. These costs can include copayments, deductibles, and coinsurance. Copayments are fixed amounts paid for services like doctor visits or prescriptions, while deductibles are the amount employees must pay before insurance coverage kicks in.

Coinsurance refers to the percentage of costs that employees are responsible for after meeting their deductible.

Impact on Compensation and Job Satisfaction

Employee health insurance costs play a significant role in overall compensation packages. A comprehensive health insurance plan can be a valuable benefit that attracts and retains top talent. On the other hand, high out-of-pocket costs or premium contributions may lead to dissatisfaction among employees.

Understanding the impact of health insurance costs on compensation and job satisfaction is crucial for employers looking to create a positive work environment.

Enrollment and Eligibility

When it comes to enrolling in an employee health insurance plan, there are specific processes and criteria that employees need to be aware of. Understanding how enrollment works and who is eligible is crucial for accessing important healthcare benefits.

Enrollment Process for New Employees

For new employees, the enrollment process typically begins during the onboarding period. Employers usually provide information on available health insurance plans and the required paperwork to sign up. It is essential for new employees to carefully review the options and select a plan that best suits their needs.

Qualifying Life Events

In the event of a qualifying life event such as marriage, birth of a child, or loss of coverage, employees may be eligible to make changes to their health insurance coverage outside of the regular enrollment period. It is important to notify the HR department promptly to take advantage of these opportunities.

Eligibility Criteria

Eligibility for employee health insurance benefits can vary depending on factors such as employment status, number of hours worked, and length of service. Employers typically have specific requirements that employees must meet to qualify for coverage. It is crucial to understand these criteria to ensure eligibility.

Open Enrollment Periods

Open enrollment periods are designated times when employees can make changes to their health insurance coverage, such as switching plans or adding dependents. It is essential to pay attention to these periods and take advantage of the opportunity to review and adjust coverage as needed.

Last Point

In conclusion, Employee Health Insurance Explained: Benefits Every Worker Should Know serves as a comprehensive guide to navigating the intricacies of health insurance in the workplace. By prioritizing employee well-being and providing valuable insights into coverage options, this discussion equips both employers and employees with the knowledge needed to make informed decisions.

FAQ Overview

What are the benefits of employer-provided health insurance?

Employer-provided health insurance offers financial protection, access to quality healthcare, and promotes employee well-being and productivity.

What are the differences between HMO, PPO, and high-deductible health plans?

HMOs require referrals, PPOs offer more flexibility, and high-deductible plans have lower premiums but higher deductibles.

How are premium contributions typically divided between employers and employees?

Employers often cover a significant portion of the premiums, with employees contributing through payroll deductions.

What is the significance of preventive care in employee health insurance?

Preventive care helps in early detection of health issues, reducing overall healthcare costs and improving employee wellness.

How can employees make changes to their coverage during open enrollment periods?

During open enrollment, employees can adjust their coverage, add or remove dependents, and explore different plan options offered by their employer.