Small Business Health Insurance Plans That Save You Thousands sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

In the realm of small business health insurance, finding ways to save money while providing quality coverage is crucial. This guide delves into cost-saving strategies, customization options, and tax benefits that can help small businesses thrive.

Understanding Small Business Health Insurance Plans

Small business health insurance plans are designed to provide healthcare coverage to employees of small businesses. These plans offer a range of benefits and options tailored to meet the needs of both employers and employees.

Key Benefits of Opting for Health Insurance Plans for Small Businesses

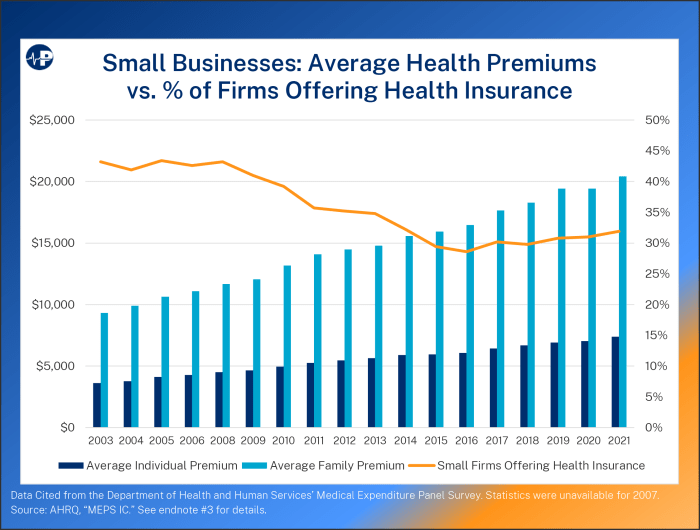

- Cost-Effective Coverage: Small business health insurance plans often provide more affordable premium rates compared to individual plans, as the risk is spread across a group of employees.

- Tax Advantages: Employers may be eligible for tax deductions on contributions made towards employee health insurance premiums, making it a cost-effective option for businesses.

- Employee Retention and Satisfaction: Offering health insurance can attract top talent and improve employee retention rates by providing valuable healthcare benefits.

- Enhanced Productivity: When employees have access to healthcare services through insurance plans, they are more likely to prioritize their health and well-being, leading to increased productivity in the workplace.

Differences Between Group Health Insurance and Individual Health Insurance for Small Businesses

Group health insurance is purchased by an employer to cover all eligible employees, while individual health insurance is purchased by individuals to cover themselves and their families. Here are some key differences:

| Group Health Insurance | Individual Health Insurance |

| Typically lower premium rates due to group purchasing power. | Premium rates based on individual factors like age, health history, and coverage needs. |

| Coverage extended to all eligible employees, often with no medical underwriting. | Requires individual underwriting, and coverage may vary based on individual health conditions. |

| Employer may contribute towards premiums, making it more affordable for employees. | Individuals bear the full cost of premiums, with no employer contributions. |

Cost-saving Strategies in Small Business Health Insurance Plans

When it comes to small business health insurance plans, finding ways to save money is crucial for the financial health of your company. By implementing cost-saving strategies, you can ensure that your employees have access to quality healthcare coverage without breaking the bank.

Compare Different Plans

One of the most important cost-saving strategies for small businesses is to compare different health insurance plans. By exploring a variety of options from different providers, you can find the most cost-effective plan that meets the needs of your employees.

Negotiate with Insurance Providers

Another effective way to save money on small business health insurance plans is to negotiate with insurance providers. By discussing your needs and budget with them, you may be able to lower premiums and save thousands of dollars in the long run.

Customizing Health Insurance Plans for Small Businesses

When it comes to small businesses, one size does not fit all, especially in terms of health insurance plans. Customizing health insurance plans for small businesses is crucial to meet the specific needs of both the company and its employees.

By tailoring these plans, businesses can ensure that they are providing adequate coverage while also optimizing costs.

Advantages of Offering Employee Wellness Programs

Employee wellness programs are a valuable addition to any health insurance plan for small businesses. These programs promote a healthy lifestyle among employees, leading to reduced healthcare costs in the long run. By focusing on preventive care and promoting overall well-being, businesses can improve employee morale, productivity, and retention rates.

- Wellness programs can lead to lower absenteeism and reduced healthcare costs, ultimately saving money for both the employer and the employees.

- Healthy employees are more engaged and productive, contributing to a positive work environment and overall business success.

- Employee wellness programs can also help attract and retain top talent, as job seekers are increasingly looking for employers who prioritize employee health and well-being.

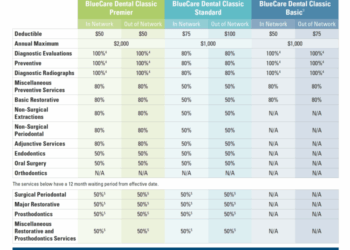

Sample Health Insurance Package with Cost-saving Features

Designing a sample health insurance package for small businesses involves incorporating cost-saving features without compromising the quality of coverage. Here is an example of a customized health insurance package:

| Feature | Benefit |

|---|---|

| High-deductible Health Plan (HDHP) | Lower premiums for both the employer and employees, with the option to pair it with a Health Savings Account (HSA) for tax advantages. |

| Telemedicine Services | Provides remote access to healthcare professionals, reducing the need for in-person visits and saving time and money. |

| Wellness Incentives | Rewards employees for participating in wellness programs, encouraging healthy behaviors and reducing healthcare costs. |

| Prescription Drug Coverage | Negotiated discounts on prescription medications, ensuring affordable access to necessary treatments. |

Exploring Tax Benefits Related to Small Business Health Insurance

Small businesses can significantly benefit from tax advantages when offering health insurance plans to their employees. By taking advantage of available deductions and credits, businesses can save money in the long run while providing valuable healthcare coverage to their workforce.

Tax Deductions for Small Business Health Insurance

One of the key tax benefits for small businesses offering health insurance is the ability to deduct the cost of premiums as a business expense. This means that the amount spent on providing health coverage to employees can be subtracted from the overall taxable income of the business, resulting in lower tax liabilities.

Tax Credits for Small Business Health Insurance

In addition to deductions, small businesses may also be eligible for tax credits for providing health insurance to employees. The Small Business Health Care Tax Credit is available for businesses with fewer than 25 full-time equivalent employees who earn an average wage of less than $50,000 per year.

This credit can cover up to 50% of the employer's contribution towards employee premiums, making it a valuable cost-saving incentive.

Financial Advantages of Tax Incentives

By leveraging tax incentives related to small business health insurance, businesses can not only save money on their tax bills but also enhance the overall financial well-being of the company. Lowering healthcare costs through tax deductions and credits can free up resources to invest in other areas of the business, such as employee training, expansion, or innovation.

End of Discussion

As we wrap up this exploration of Small Business Health Insurance Plans That Save You Thousands, it's evident that with careful planning and strategic decisions, small businesses can secure comprehensive health coverage without breaking the bank. By leveraging the tips and insights shared here, businesses can navigate the complex landscape of health insurance with confidence and financial savvy.

FAQ Guide

How can small businesses save money on health insurance plans?

Small businesses can save money by comparing different plans, negotiating with insurance providers, and exploring cost-effective options tailored to their needs.

What are the key benefits of opting for health insurance plans for small businesses?

Key benefits include providing financial security for employees, attracting top talent, and offering tax benefits for the business.

How can small businesses customize health insurance plans to suit their specific needs?

Small businesses can tailor plans by including wellness programs, designing packages with cost-saving features, and ensuring coverage aligns with employee needs.